Research that gives you a competitive edge

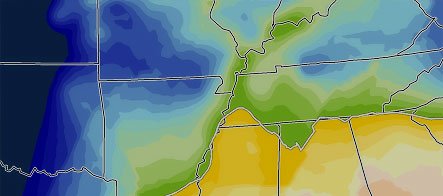

Basis maps utilize spatial analysis to estimate the effects of supply and demand, transportation and commodity costs on local grain prices.

Basis is the difference between local cash prices and the nearby futures price. The next crop contract set to expire on the Chicago Board of Trade is known as nearby futures.

Local cash prices for corn and soybeans are gathered from 2800-3200 locations and then analyzed using a Geographic Information System (GIS) to estimate the basis of regions without observations. These maps are colored in five cent intervals with the dotted line delineating positive from negative areas. With few cash prices available in the South Eastern and Western regions, care should be taken when interpreting the estimated basis outside the Corn Belt. Wednesday price data is used in these maps and updates are posted weekly.

Corn Basis 11/13/2024 (Figure 1)

Soybean Basis 11/13/2024 (Figure 2)

Your dedicated Relationship Manager will help you access deeper research that is most beneficial to your business. Make time to speak with your Relationship Manager today.

RaboResearch Podcast Series

Learn More

Our research gives you a competitive edge

Learn More