Rabobank Releases Report on U.S. Row Crops Nearing the Point of Stabilization

Report explores outlook for U.S. farmers

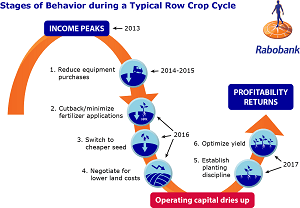

St. Louis, Mo. (March 2, 2016) – As U.S. row crop farmers brace themselves for a third year of negative net income, Rabobank believes that – for at least the next five years – market forces will drive stabilization in profit margins near the long-term average breakeven levels. These findings are part of a new report from the Rabobank Food & Agribusiness Research and Advisory group, which explores the period of tight margins U.S. row crop farmers are currently operating in and the ways in which farmer focus will change.

St. Louis, Mo. (March 2, 2016) – As U.S. row crop farmers brace themselves for a third year of negative net income, Rabobank believes that – for at least the next five years – market forces will drive stabilization in profit margins near the long-term average breakeven levels. These findings are part of a new report from the Rabobank Food & Agribusiness Research and Advisory group, which explores the period of tight margins U.S. row crop farmers are currently operating in and the ways in which farmer focus will change.

“Farmers will need to continue conserving liquidity and maintain alternative sources of capital as the industry adjusts to this ‘new normal’ environment of lower profitability and trends toward more stability,” notes report co-author and Rabobank analyst Ken Zuckerberg.

The report notes there is a cost to this stability, namely that individual input categories will need to readjust as a proportion of the new total crop value.

“The most likely scenario is that high-value-added inputs, particularly specialty seed and crop protection products, will represent a greater portion of farmer wallet share, compared to machinery and bulk fertilizers,” notes report co-author and Rabobank senior analyst Sterling Liddell. “As the crop cycle transitions to stability, we see several implications.”

The report, “Ch-ch-changes: U.S. Row Crops Near the Point of Stabilization,” also finds farm input providers will need to deliver more value to cost conscious growers and smaller scale farms may be forced into strategic mergers or vertical integration strategies.

“There is no doubt that in order for U.S. row crop farmers to be successful and sustainable, they will need to readjust and reposition for the future,” says Zuckerberg.

A full copy of “Ch-ch-changes: U.S. Row Crops Near the Point of Stabilization,” is available by contacting Sarah Kolell at Rabo AgriFinance.

CONTACTS:

FAR Report Requests/Media Inquiries

Sarah Kolell

Rabo AgriFinance

(816) 516-7984

Sarah.Kolell@RaboAg.com

Jessup Wiley

Rabobank, N.A.

(559) 447-7946

Jessup.Wiley@rabobank.com

About Rabo AgriFinance

As a leading financial services provider for agricultural producers and agribusinesses in the United States, Rabo AgriFinance adds value using industry expertise, client-focused solutions, and by creating long-term business relationships. Rabo AgriFinance offers a comprehensive portfolio of services that gives producers the right products to prepare for, and take advantage of, market opportunities. Rabo AgriFinance representatives offer a wide array of financial services and knowledge to help customers realize their ambitions. This comprehensive suite of services includes loans, insurance, input finance and effective risk management products. Rabo AgriFinance is a division of Rabobank, the premier bank to the global agriculture industry and one of the world’s largest and safest banks.

About Rabobank, N.A.

Rabobank, N.A. is a California community bank and a leading provider of agricultural financing and full-service banking products to California consumers, businesses, and the agriculture industry. With nearly 120 retail branches, we serve the needs of communities from Redding to the Imperial Valley through a regional structure that promotes local decision-making and active community involvement by our employees.

Rabobank, N.A. is a division of Rabobank Group, the premier lender to the global food and agricultural industry and a financial services leader providing commercial, retail, and agricultural finance solutions in 48 countries around the world. From its century-old roots in the Netherlands, Rabobank has grown into one of the world’s largest and safest banks. www.rabobankamerica.com